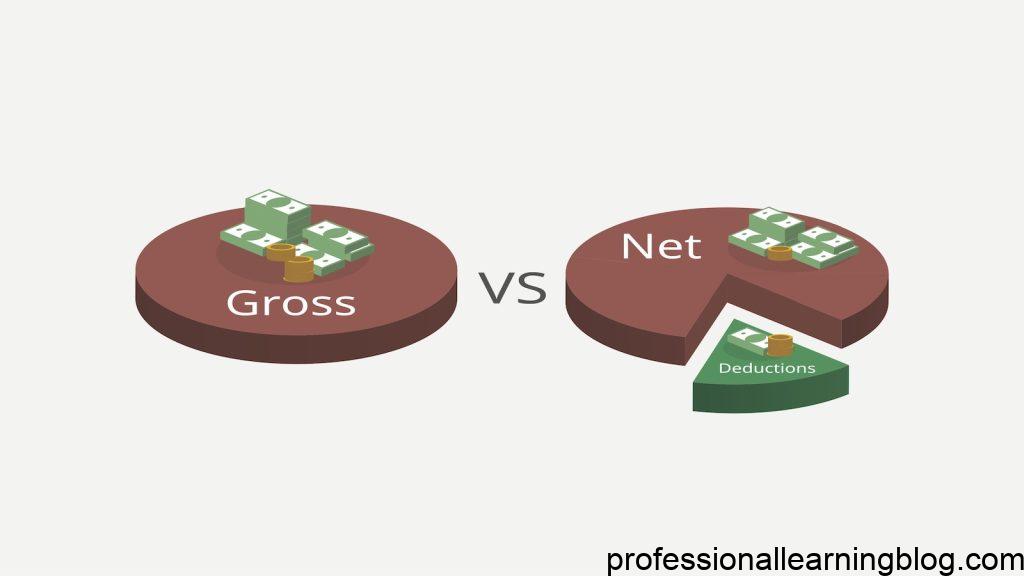

Understanding the difference between gross and net pay is essential for businesses and employees alike. What is the difference between Gross and Net Pay Everfi? Gross pay is the total amount of money an employee earns before taxes or other deductions are taken out, when net pay is the amount an employee takes home after all deductions have been made.

Gross Pay

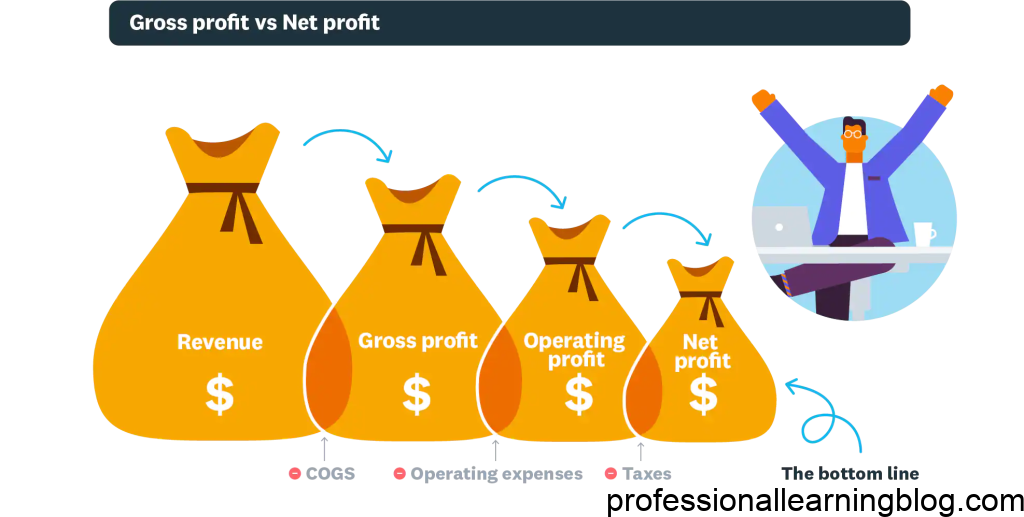

Gross pay is the total amount of money an employee earns before any taxes or deductions are taken out. It includes all wages, salaries, bonuses, commissions and other forms of income. Gross pay is the most essential figure when it comes to calculating taxes. it’s also the figure used to determine an employee’s eligibility for specific benefits, such as health insurance or pension plans.

Net Pay

Net pay is the amount of money an employee takes home after all deductions have been made. This includes federal and state income taxes, Social Security and Medicare taxes and any other deductions required by law. It also includes any deductions made for pre-tax benefits such as health insurance and retirement contributions. Net pay is the amount of money an employee actually receives in their paycheck. it’s also the amount – that used to calculate an employee’s take-home pay.

Taxes

Taxes are one of the main deductions taken out of an employee’s gross pay. Federal and state income taxes, Social Security and Medicare taxes and any other taxes required by law are deducted from gross pay. These taxes are used to fund various government programs, such as Social Security and Medicare. The amount of taxes an employee pays is based on; their taxable income, which is determined by their gross pay.

Deductions

Deductions are any money taken out of an employee’s gross pay for a specific purpose. This includes pre-tax deductions for benefits such as health insurance or retirement contributions. It also includes deductions for taxes and any other deductions required by law. All deductions, including taxes, are taken out of an employee’s gross pay before their net pay is calculated.

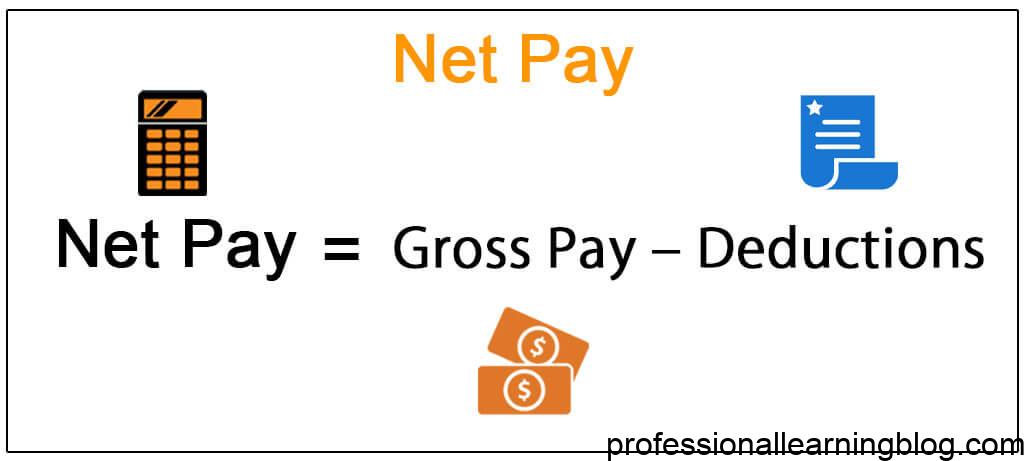

Calculating Pay

Calculating an employee’s gross and net pay is a relatively simple process. The employer first calculates the employee’s gross pay by adding up all of their wages, salaries, bonuses, commissions and other forms of income. Then, any taxes or deductions required by law are taken out of the gross pay. The remaining amount is the employee’s net pay.

Payroll Records

It is essential for employers to keep accurate records of their employees’ gross and net pay. These records should include detailed information on; all wages, salaries, bonuses, commissions, deductions and taxes. They should also include any other information pertinent to the employee’s pay, such as overtime or holiday pay. Accurate payroll records are essential for proper tax reporting and for ensuring – that employees are paid accurately and timely.

Benefits

Employees may be eligible for specific benefits depending on; their gross pay. For example, some employers may offer health insurance or pension plans to employees who make above a specific amount of gross pay. Other benefits, such as disability insurance, may also be available to employees who make more than the minimum amount of gross pay.

Understanding the difference between gross and net pay can help businesses and employees alike. Gross pay is the amount before taxes and deductions and net pay is the amount you take home after all deductions have been made.

You can quick lookup our other articles. “Legitimate Work From Home Jobs No Experience Needed” and “Feeling Nauseous All the Time but Not Throwing Up“